No products in the cart.

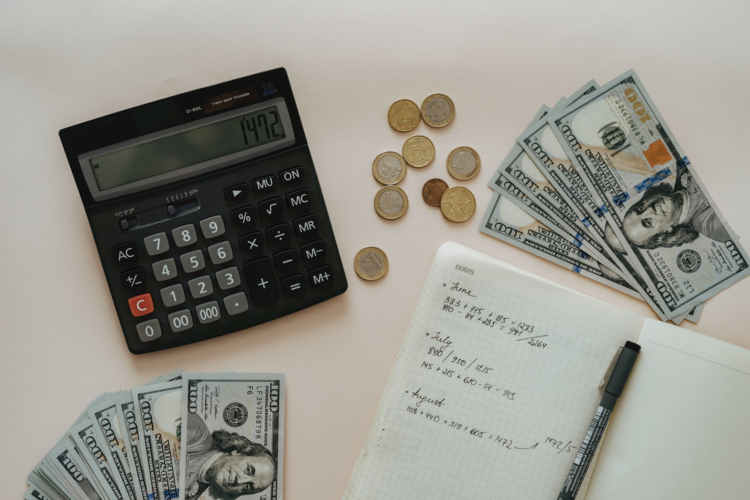

3 Ways to Optimize Your Taxes You Need to Know About

Warren Buffet famously laughed as he talked about his secretary paid higher taxes than he did. When it comes to taxes, there is so much information to know and utilize that it can be hard to know where to begin. It’s difficult to feel confident, giving how much there is to know and how quickly the tax code changes. To make matters more overwhelming, each choice you make can end up costing you more money. Talk about pressure! The following will explore three things that you can do, no matter how strong your understanding of tax law, to optimize your taxes.

- Understand What You Can Write Off

Especially with so many people working from home or in unusual circumstances this year, many of us have work expenses like our laptops, internet bills, electricity bills, and phone bills that can be included in our taxes. Take a little time to learn about what can be written off when it comes to work-from-home expenses and begin saving your receipts and proofs of purchase. You’ll be amazed how quickly these dollars add up.

- Keep Up With the Changes in the Tax Code

Especially when it comes to your retirement savings plans, changes in the tax code (which happen pretty regularly) can drastically impact how hard you’ll be hit by your taxes when you decide to retire. Experts at Bogart Wealth emphasize that keeping up with the latest developments in the tax code is an essential part of the planning and optimizing of your taxes. Try to find somewhere that publishes a reputable weekly commentary on the changes that are ongoing when it comes to taxes.

- Consult an Expert

Of course, whatever your specific situation is will have its own tax implications. There might be decisions that you could be making right now to save you money down the line. Is your teenager also at home lots? Do they help out with your work? You can pay them and avoid taxes on the money you used to do so. As a bonus, they’ll be getting the work experience that they’re probably missing out on due to the pandemic. There are countless little choices just like the one mentioned above that you could be taking advantage of to save yourself some money in the future. An expert will be able to guide you towards these options.

With the above three tips kept in mind, you’re well on your way to optimizing your taxes. Of course, every person and every business is different so the application of the above tips is going to look different as well. As with any financial and legal advice found online, always consult a professional if you feel unsure of how the information you’re learning applies to your particular situation. This being said, one thing remains true for all of us regardless of our situations: the more knowledge you gain about the tax code and the system, the better your chances are of making sound decisions that will leave you happy not only this coming tax season but tax seasons well into the future.