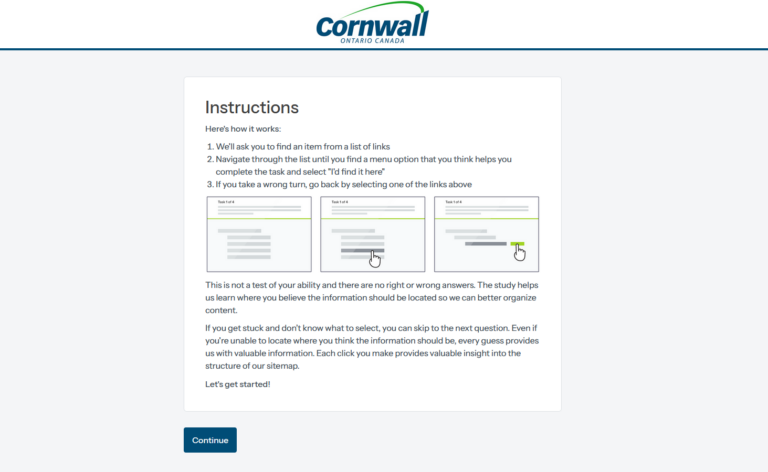

If you’re living in Canada and are looking to get your hands on some cash to get yourself out of a rut or get into an investment, you’ll find that there are several options available. But before you consider taking out a reverse mortgage on your home, here’s everything you need to know to make sure you’re making the right decision:

What is a reverse mortgage?

A reverse mortgage is an insurance policy that allows a homeowner to access 55% of the value of their home into tax-free cash. The mortgage pros at https://www.reversemortgagepros.ca/reverse-mortgage/ explains that this gives you the opportunity of converting the equity into cash, which you can receive as a one-time payment or periodical payments according to your preference. It is considered as a lifetime loan for as long as you live, or as long as you own the property.

Unlike a normal mortgage, having a reverse mortgage does not require the payment of interest until you leave the house, and as long as you choose to live in the house. The bank will not be able to evict you under any circumstances. Making it a safe way to get the cash you need without worrying about losing your home.

Requirements of a reverse mortgage

In order to be eligible for a reverse mortgage, there are certain criteria that must be followed:

- You must be over 55 years of age. (If you have a spouse, they should also be over 55 years of age)

- You must be a Canadian homeowner.

Advantages of a reverse mortgage

- No monthly mortgage payments

- Repayment of loan is only required when the house is sold.

- Allows you to stay in your home without worrying about being evicted

- Allows you to get 55% of your home’s value in cash to be used without worrying about repayment.

- Benefit of appreciation of your home value.

- Maintain financial freedom and independence.

- No interest to be paid while you’re staying in the house. It will all be calculated and deducted from the value of the house once you move or decide to sell it.

Disadvantages of a reverse mortgage

- Very high-interest rates, a lot higher than normal mortgage rates.

- The more equity you buy, the more interest you pay.

- There are penalties for selling your home within the first three years.

- If you pass away, the value of the mortgage will be paid first, leaving your heirs with less money. The amount you owe including the interest will need to be paid within a short period of time.

- High setup costs (application fee, closing costs, home application fee) are deducted from the amount you receive.

When you’re in need of cash, it’s always wise to look at all the options you have. However, before you make a serious decision such as this, it is essential that you do your research thoroughly and ensure that you’ve weighed out all your options. That way, you’ll be sure that the choice you make is not only the most appropriate, but also the one with the best benefits and the least drawbacks according to your current situation.