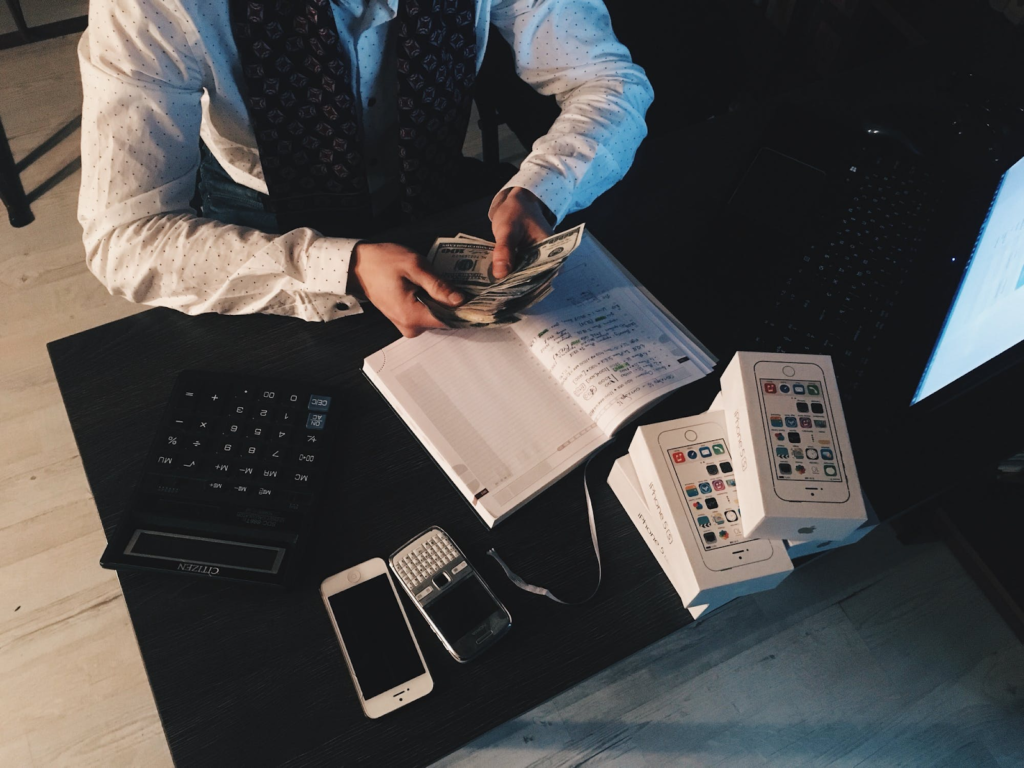

A business can be fun and glorious in almost every aspect, but when it comes to getting your finances in check, it’s a hardly enjoyable matter. Numbers and calculations are taken extremely seriously in any business, which means that handling yourself without prior experience can create an ordeal out of this process. For a small business to hire an accountant that handles all its finances as an employee, it will have to pay out-of-pocket expenses that can affect other important sides of its operation. Fortunately, technology found a way to make this process easier for everyone involved.

To help you wrap your head around the digital tools that can help your small business with finances and accounting, we’ve created a brief overview of the different types available.

Benefits of Digital Business Tools

The audience that the majority of accounting and finance tools are made for is usually a non-accounting one. This is because the software is designed to simplify accounting through the use of automated systems and calculations. Fortunately, a big part of the financial calculation is standardized according to the business type and taxes. A business owner can simply boot up an app or software that can help them finish important accounting operations without actually having any experience in accounting. There are digital tools that can even help businesses secure loans to finance their business plans. As mentioned on https://www.ebroker.com.au/, real-time results from digital platforms can help you find a lender for your business. Digital tools aren’t only used in the intricacies of the business operation, but also as a way to get your feet on its legs.

Reducing the margin of error is very important in a field like accounting, as errors can sometimes translate to huge losses and penalties. The transparency of software leaves no room for human error, making it quite popular with auditors because everything is on a level field. Documentation of the operations and safety checks are all common features in financing digital tools.

Database Financing Software

Often used by big corporations that have a lot of important details to track, database financing software is a popular choice for big businesses. It’s not often chosen or used by small businesses because it requires a certain degree of maintenance that makes it quite expensive for small budgets. This doesn’t mean that it should be disregarded, as some small businesses may gradually start transitioning to such software as they grow. Big businesses hire systems engineers and consultants to create, manage, and integrate the software into the company. The accounting functions that database accounting software can handle are quite diverse and complex, making it more efficient for lending institutions, corporations, banks, and other big companies.

Local Accounting Software

Accounting software installed on a computer or a closed network of a business is called an installed or local accounting software. There is a myriad of accounting tools that can be installed on computers to facilitate the accounting process in your company. The main advantage that locally installed accounting software has over other forms of software is that it doesn’t need the internet to work, which allows for its operation in remote locations with unstable or no internet coverage. The complexity and scope of action that local accounting software offers are quite impressive since it’s designed to be operated using the full potential of a computer. This usually comes at the price of being more difficult to use and learn, but it’s you who decides if you’d like to use them or not. A lot of small business owners with experience in accounting and bookkeeping prefer using installed accounting software to ensure that they have more control over their software.

Cloud-Based Accounting Software

The cloud is a recent technology that has revolutionized the digital world thanks to its numerous features and benefits. Using many servers located across the globe to create a stable network that allows users to benefit from its features from anywhere in the world is a true lifesaver. Cloud-based accounting software doesn’t need to be installed on specific computers because

the data can be accessed from any place with the internet. It’s quite secure and cost-effective, making it the first choice of many small business owners. It may not offer the complex features that database and installed accounting software can provide, but it’s quite efficient and friendly for the majority of basic accounting operations you’d need.

Small business owners are able to handle the majority of their finances using digital tools, not to mention other tools that make an accountant’s job more accurate. Small business owners who ignore or avoid utilizing the digital tools available miss a lot of opportunities that can help increase the business’s growth potential.