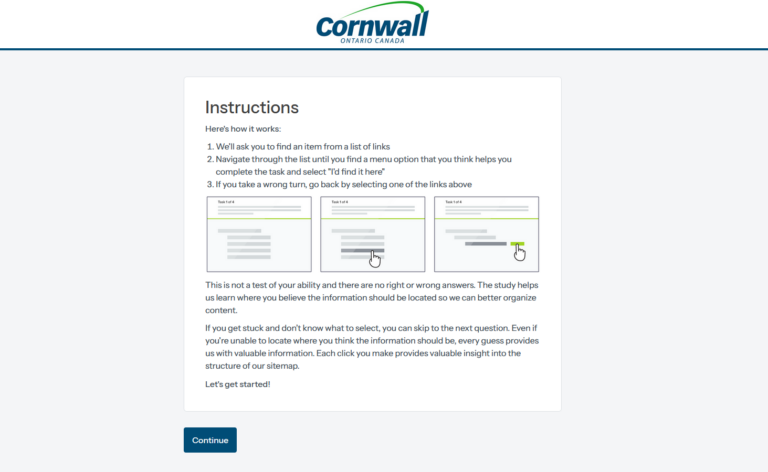

In the modern world, financial crimes are becoming increasingly complex and international in nature. Against this backdrop, Interpol plays a crucial role in coordinating the efforts of law enforcement agencies from various countries to combat crimes that threaten financial stability and security. Let’s explore how Interpol tackles financial crimes, the types of offences it monitors, and the methods employed to prevent and combat them.

What is Interpol?

Interpol is an international criminal police organisation, established to facilitate cooperation between law enforcement agencies of various countries in the fight against crime. A key aspect of Interpol’s work involves combating financial crimes, which often have a cross-border nature and require coordinated efforts from multiple countries for their successful prevention and investigation. As part of its operations, Interpol interacts with national police services, judicial bodies, international organisations, and the private sector to ensure effective information exchange and coordination of efforts in tackling financial crimes.

Types of financial crimes tracked by Interpol

Money laundering: Tracking illicit financial flows

Money laundering is one of the most serious financial crimes, posing a threat to the global financial system. Interpol actively works to identify and halt money laundering schemes, which often involve complex and multi-layered operations spanning multiple jurisdictions. Utilising international laws such as the UN Convention against Transnational Organized Crime (the Palermo Convention) and the European Union’s Anti-Money Laundering (AML) directives, Interpol coordinates the efforts of law enforcement agencies and financial institutions to track illegal money flows and reintegrate criminal proceeds back into the legitimate economy.

2. Fraud: Detection and Prevention of International Fraud Schemes

Fraud is another significant type of financial crime that Interpol actively combats, and it is particularly prevalent in developed financial centres. Dubai, being a major international hub for investment and trade, encounters various forms of fraud, including Ponzi schemes, credit card fraud, and cyber fraud. These crimes can cause substantial damage to both individuals and large corporations.

Interpol plays a pivotal role in identifying and thwarting such crimes, working closely with Dubai law enforcement agencies and the private sector. Joint efforts are focused on information sharing and the coordination of international investigations, enabling swift responses to threats and minimising their impact. Should you need to, you can reach out to financial crime lawyer in Dubai, who will skilfully coordinate your actions and help recover the losses incurred.

3. Corruption: Collaborating with countries to combat government and corporate corruption

Corruption undermines the foundations of the rule of law, erodes trust in both public and private institutions, and fosters the growth of organised crime and financial offences. Interpol actively supports efforts to combat corruption, assisting countries in identifying and investigating corrupt activities within both government and corporate structures. In its operations, Interpol relies on international standards such as the United Nations Convention against Corruption (UNCAC) and collaborates with prosecutorial bodies, anti-corruption agencies, and non-governmental organisations.

4. Counterfeiting and Intellectual Property Crimes: Protecting Businesses from Counterfeit Goods and Intellectual Property Theft

Counterfeiting and intellectual property theft cause significant harm to the economy and undermine consumer trust. Interpol supports law enforcement agencies in combating counterfeiting and intellectual property infringements by coordinating international operations to halt illegal trade and protect intellectual property rights. In this endeavour, the organisation collaborates with the World Intellectual Property Organization (WIPO) and national patent offices, utilising international treaties such as the Paris Convention for the Protection of Industrial Property.

In the event of the unlawful imposition of sanctions related to the economic sphere against you or your company, we recommend seeking legal support from sanctions lawyers. Experienced solicitors will promptly take steps to protect your interests, including the implementation of internal control systems to ensure compliance with the law and the protection of your rights.

How does Interpol work?

Interpol’s work in combating financial crimes is based on several key components. Firstly, there is the effective exchange of information between law enforcement agencies of different countries. Interpol uses a global network to share data about suspects, financial transactions, and criminal schemes, allowing for a swift response to emerging threats. Secondly, Interpol conducts joint international operations aimed at identifying and stopping financial crimes. These operations include both operational actions and analytical work to identify trends and new methods of criminal activity. Thirdly, Interpol actively participates in the development and promotion of international standards and best practices in the fight against financial crimes, providing member states with access to necessary tools and resources.

Strategies for combating financial crimes

1. Implementing strict internal controls: financial audits, segregation of duties, and software for fraud detection.

One of the key aspects of combating financial crimes is the implementation of stringent internal control measures within organisations. These measures include regular financial audits, which help to identify anomalies and potential signs of fraud. The segregation of duties among employees reduces the risk of fraud, as no single individual has complete control over financial transactions. Moreover, the use of specialised software for fraud detection helps to promptly identify suspicious transactions and schemes, thereby mitigating risks and protecting the company’s assets.

2. Employee training programmes: regular training in identifying and reporting financial crimes

Employees of an organisation must be informed about the risks of financial crimes and the methods to prevent them. Regular training programmes play a crucial role in raising employee awareness about the signs of fraud and their duty to report suspicious activities. This training should cover both the basic principles of financial security and specific threats unique to a particular industry. International standards and best practices, developed with Interpol recommendations in mind, can serve as a foundation for designing such programmes.

3. Due Diligence: Checking business partners, monitoring transactions, and adhering to AML regulations.

Conducting thorough due diligence on business partners and monitoring transactions are key elements in preventing financial crimes. Organisations must carry out detailed checks on their partners and clients to ensure their reliability, financial stability, and compliance with legislative requirements. This includes analysing financial statements, checking for any connections with criminal organisations, and assessing reputational risks. Moreover, adhering to anti-money laundering (AML) regulations helps to prevent the financial system from being used for illicit operations.

5 leading countries

Certain countries stand out for their efforts in combating financial crimes and their close cooperation with Interpol. These include the United States of America, the United Kingdom, Germany, Canada, and Australia. These nations actively participate in international initiatives aimed at fighting financial crimes, implement cutting-edge methods of financial monitoring and control, and share their findings and experiences with other countries. Their efforts encompass both the development and implementation of national legislation, as well as active participation in international treaties and agreements designed to curb financial crimes.

How can a financial crime solicitor assist you?

Financial crime solicitors play a pivotal role in protecting the interests of organisations and individuals facing charges of financial misconduct or suspected involvement in such schemes. Should you encounter any issues, do get in touch, and our qualified solicitors will provide advice on compliance with legislation, assist in developing and implementing internal policies and procedures aimed at preventing financial crimes. Our team will offer legal defence in your court and administrative proceedings. Solicitors from our law firm specialising in financial crimes can also assist with conducting internal investigations and liaising with law enforcement agencies, including Interpol.