Managing your money can be accomplished in a variety of ways. One of the things that you have to plan for in terms of financial responsibility is taxes. There are many to consider and if you aren’t careful, it will be easy to get lost and feel overwhelmed trying to manage your taxes. Here are some important factors to consider in order to efficiently manage your taxes and resume responsibility for your money.

Plan Ahead

The first thing you need to do when considering your taxes and how to properly manage them is to plan ahead. There are certain dates when it comes to doing taxes that need to be met, and these dates depend on the type of taxes you file. From personal income to property taxes, there are different times that are dedicated to them throughout the year, and it is your responsibility to meet all the deadlines. Failure to do so can lead to penalties as they accumulate over time. The best way to effectively manage your taxes is to start well ahead of the schedule, as you can factor in any changes or hiccups in your schedule and are not left scrambling to complete and fulfill your responsibilities.

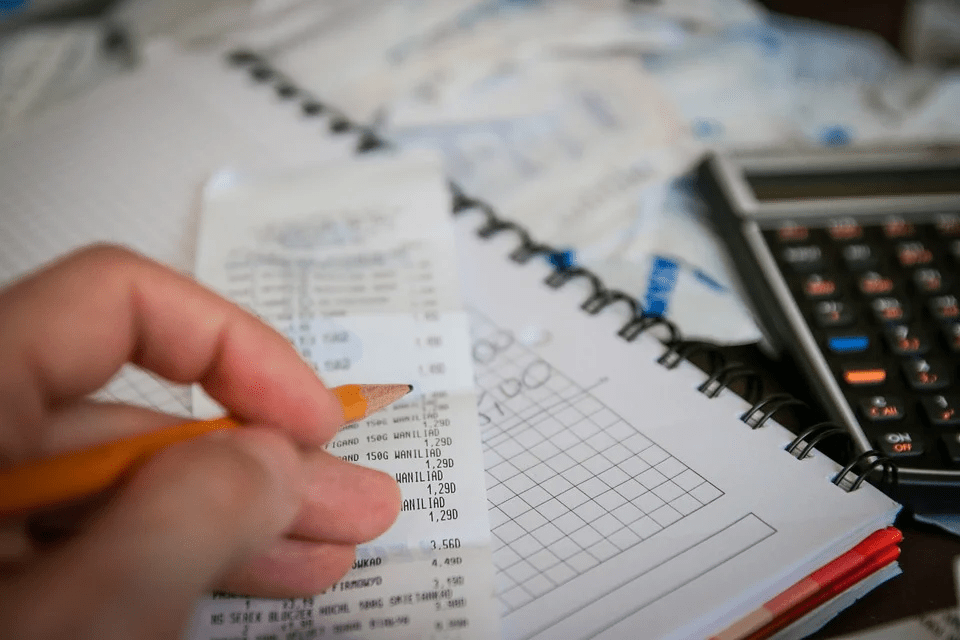

Keep a Record

It is important that throughout the year, you not only keep the proper documents and information recorded, such as yearly income but also that you sort them properly in an organized manner. You can do this by creating your tables and labeling them accordingly, or utilize the tools available to you through a variety of resources. The financial experts at Keeper Tax recognize the importance of this organization, as throughout the course of the year when it comes down to tax season and submitting all the necessary documentation, it will ensure that you will be able to complete the process efficiently and with little stress or hassle. Additionally, staying organized also helps increase the accuracy of your numbers, and this is important if you were ever to get audited in order to confirm your submission.

Forms

When the tax season begins to approach, you want to make sure that you have all the documents and forms that you need. This is especially important if you are doing and submitting your own taxes, as those forms will help guide you through the steps and which numbers will apply to certain sections. If you are having a professional do your taxes, still having the correct forms helps you complete your taxes faster. Ensuring that you have the right forms also reduces the likelihood of mistakes and the risk of being audited, having the government reassessing your submissions.

Do You Need Help?

As previously mentioned, not everyone will be doing their own taxes. Many will have someone handling their finances for them. It is important to note that there are many tools to complete personal income tax forms, and this is common. However, there are other taxes associated with those with a much larger income or running their own businesses or companies, that it is smart to have a professional look over your numbers to guarantee their accuracy. As previously stated, even if you have someone helping you do your taxes such as an accountant, make sure you stay on top of dates and provide the necessary forms and documents to make their job easier and faster. This is because you won’t be their only client, and when it comes to tax season, most professionals will be very busy and any disorganization does not help the situation.

Safe Storage of Data

After you have submitted your taxes, you want to keep them somewhere safe. There is a lot of information within the documents that you have used to fill out the tax forms. You want to keep all that information secure and organized. With physical documents, you can use a filing cabinet to help you stay organized while saving documents on a hard drive or external memory space is ideal for electronic data. Additionally, you will want to file your completed and returned taxes together, whether you end up receiving your returns in the mail or electronically as well. This is good to have if you ever need to access past financial information.

Managing your money is a way to show your grasp of financial responsibility. Handling and completing your taxes is essential as a functioning member of many societies. If you are still struggling with these aspects, there are plenty of resources to help and support you, as well as professionals you can always reach out for guidance and assistance.