Having good health insurance is something everyone should prioritize, yet many of us overlook its importance in our lives until it’s too late. Your health and well-being are far too important to postpone or put on the back burner – with rising healthcare costs, inadequate coverage can leave you severely exposed financially if a medical emergency arises. In this blog post, we discuss the top reasons why having quality health insurance is more than worth the investment: from avoiding high out-of-pocket expenses to giving you peace of mind that comes with knowing your family will be taken care of. Let’s dive into what really makes investing in an appropriate level of insurance worthwhile!

Understand the Basics of Health Insurance

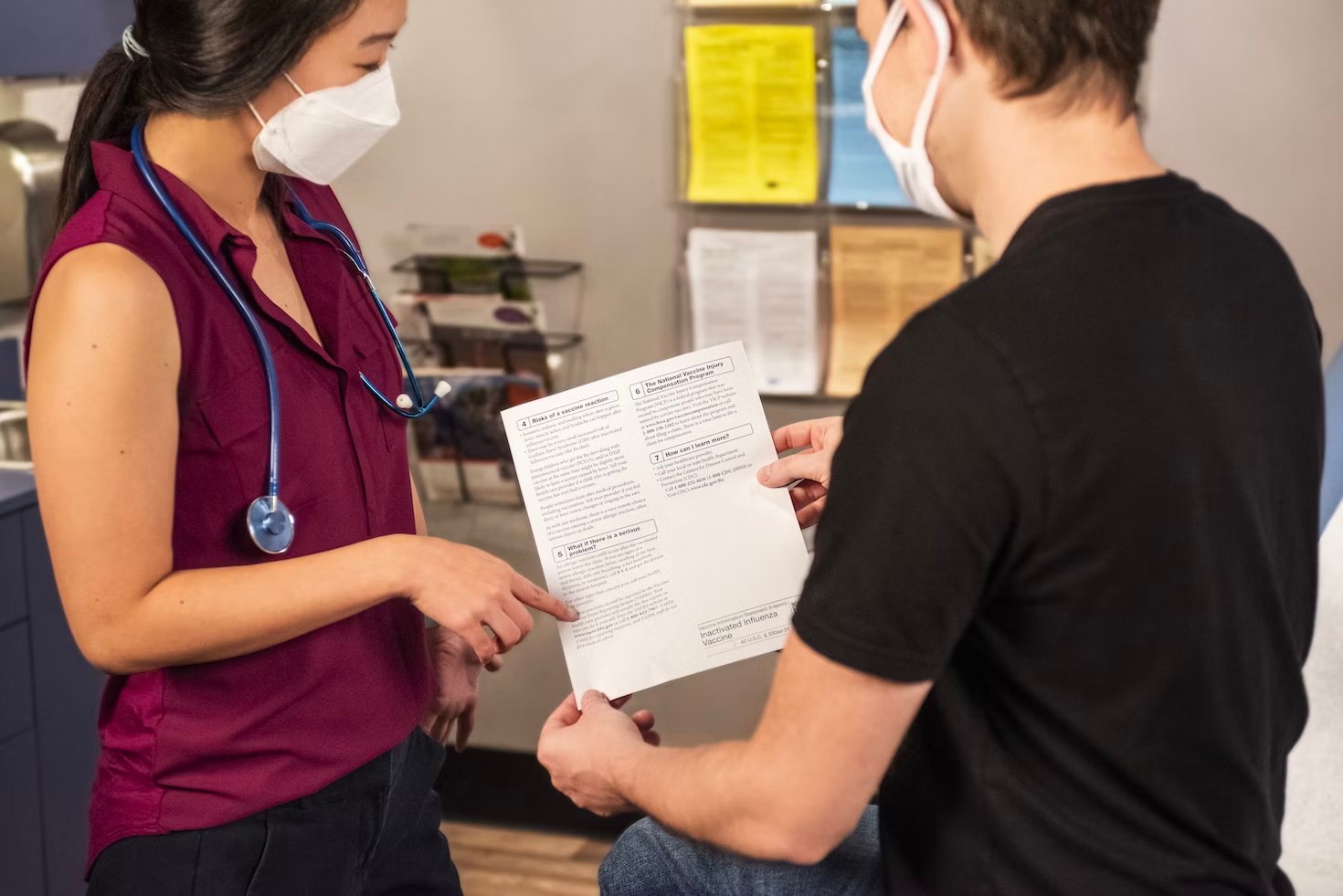

Health insurance is an essential aspect of life that everyone should understand. It helps us to cover a large part of the medical expenses that can often be quite expensive. Many people may be intimidated by the technical jargon and various terms associated with health insurance. However, it doesn’t have to be that way. Understanding the basics of health insurance can go a long way in helping you make informed decisions about your health and financial well-being. At its core, health insurance is a contract between you and your insurance provider, where you’ll pay a premium to access specific health care benefits. Whether you’re young and healthy or older with more medical needs, understanding the basics of health insurance can help you to make the best choices for your life and health.

The Benefits of Having Good Health Insurance Coverage

Having good health insurance coverage can provide numerous benefits, both for individuals and their loved ones. Beyond simply being able to afford necessary medical treatments, good health insurance can also give individuals peace of mind. Knowing that one’s medical needs are taken care of can eliminate stress and worry, allowing individuals to focus on other aspects of their lives. Additionally, with good health insurance, individuals may be able to receive preventative care and checkups regularly, catching potential health issues before they become serious problems. This can lead to better overall health and a longer, more fulfilling life. Overall, investing in good health insurance coverage can have a positive impact on both physical and mental well-being. This is a benefit not only for you but also all of your loved ones who want you to live long.

How to Find the Right Insurance Plan for You

Choosing the right insurance plan can feel overwhelming. With countless options available, it can be difficult to know where to start. However, taking the time to research and compare plans is essential in order to find the one that’s right for you. Start by considering your specific needs: what type of coverage do you require, and what is your budget? Once you’ve established these basics, begin exploring your options in depth. Look into different providers, read reviews, and compare prices to make an informed decision. Remember, finding the perfect insurance plan is well worth the effort, as it provides peace of mind and protection should the unexpected occur.

How Much Does Good Health Insurance Cost

When it comes to maintaining good health, having insurance coverage that provides comprehensive medical services is essential. However, the cost of health insurance can vary depending on several factors such as age, location, and the level of coverage selected. If you’re looking for cheap health insurance Dallas TX has to offer, see if there’s a custom plan that can fit into your healthcare budget. While some may find the premium for a comprehensive plan daunting, the cost of being uninsured can be far greater in the long run. This is because the cost of healthcare services and treatments without insurance can quickly add up and lead to financial strain. Thus, the investment in good health insurance is a wise and necessary one for safeguarding both physical and financial well-being.

It is important to learn the basics of health insurance and understand more about the benefits of having health insurance coverage. Doing your research on finding the right plan for you, comparing plans side by side depending on what type of coverage you need and cannot go without, as well as considering what kind of premium budget you have will help you get the most out of health insurance. Furthermore, making sure that you have adequate coverage keeps you from encountering any more serious issues down the road. All in all, shopping for an effective health insurance plan should not be overlooked – it can save money and protect your finances and well-being in case something does go wrong.