And so are the rebates.

Poilievre’s Axe the Tax campaign revolves around a theory that Canadians would be better off financially if they did not pay carbon taxes (henceforth referred to as CT).

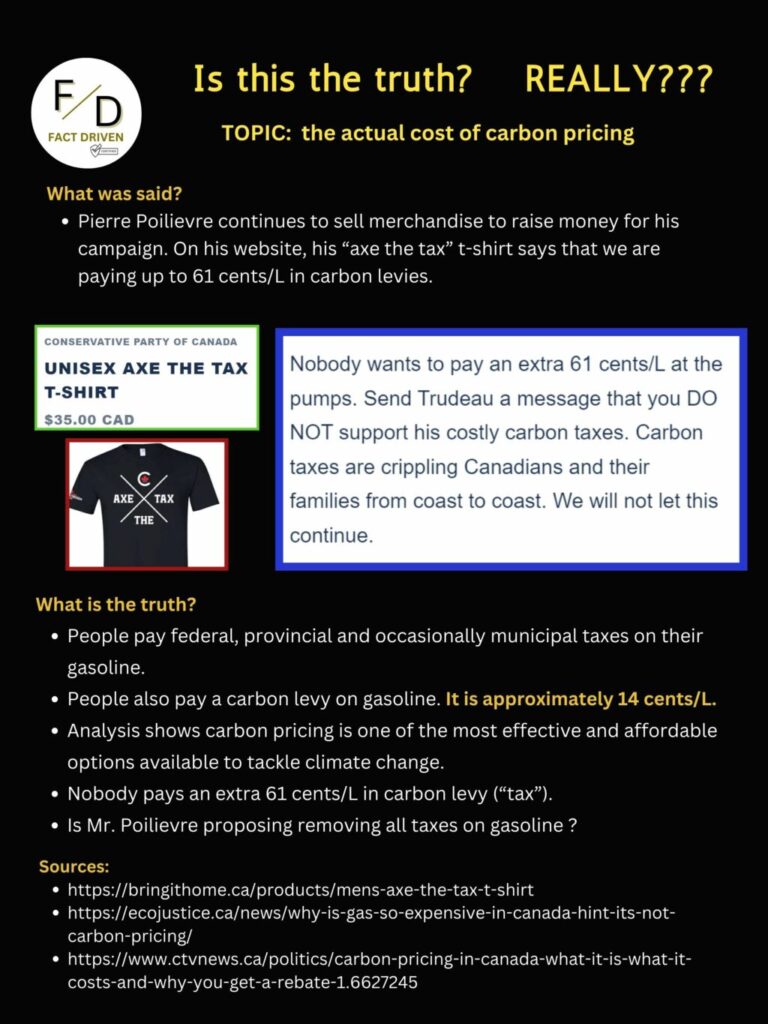

His pressure tactics include a December 7 & 8 interruption of the House of Commons with a vote blitz until the Liberals “Axed the Tax” on carbon emissions, extensive public speaking on the subject with no clear outline of how much better off we would be in real dollars and cents and selling an “axe the tax” t-shirt for a modest $35 on his website. The site claims: “Nobody wants to pay an extra 61 cents/L at the pumps. Send Trudeau a message that you DO NOT support his costly carbon taxes. Carbon taxes are crippling Canadians and their families from coast to coast. We will not let this continue.” But Canadians actually pay about .14 cents in carbon taxes. The rest are federal, provincial and sometimes municipal taxes.

We easily forget that “Canadians” include businesses that emit vast amounts of greenhouse gases. Many companies could be better off financially in the short term by not paying a CT. However, this would also mean they would not curb their emissions and we would all suffer down the line.

The first thing people lose sight of in the carbon tax debate is how the CT works.

The CT is essentially an accountability tax on carbon-emitting consumption. Its purpose is to create a financial incentive for individual and corporate consumers to reduce carbon emissions via their energy choices. If you use a lot of energy directly – in fuel consumption, or indirectly – in your consumption of goods and services, then you pay more CT. If you use less energy, you pay less.

When I thought about it, I realized that it’s an excellent system in terms of how fair it is.

I don’t like the idea that Mr. Rich has more rights than me. And unfortunately, in a capitalist world, he does.

Mr. Rich gets rich by selling his products or services as a business owner. Mr. Rich extracts raw materials from the earth to make his products (minerals, metals, wood, water etc.). He extracts, pollutes, and uses more energy than I do. If services are his gig, he relies on energy and products to deliver those services and still uses more energy and resources than me.

He provides goods and services through the people he employs and usually makes a lot more $$$ than them. Because he is wealthy, Mr. Rich also spends more on himself than I do ( a LOT MORE!).

And yet – Mr. Rich is still only 1 human being.

If my pollution load amounts to a small amout while Mr. Rich’s is a huge amount does it not stand to reason that he should pay more to clean up his pollution when his actions damage shared global resources?

Carbon pricing is directly scaled to consumption. If someone can afford to live in a 2500+ sq ft house, have 2 cars, travel regularly, and eat in a restaurant, they can afford to pay the carbon tax on the pollution levels they produce.

Does the CT work? You bet it does! It is recognized as one of the most effective and efficient approaches to reduce the greenhouse gas emissions that cause climate change. It creates a financial incentive for people and businesses to pollute less.”

But how does Poilievre’s statement “farmers pay huge carbon taxes” relate to the cost of food?

Farmers don’t pay CT on fuel for driveable machinery (trucks, ploughs, combines etc.). They do pay CT to heat their buildings with natural gas.

Mr. Poilievre uses Carleton Mushroom Farms (www.carletonmushroom.com) as an example of a “family-run” farm that is being punished through huge carbon taxes. In 2023, Carleton Mushrooms paid @$12,000 in monthly CT equalling around $150,000 CT per year in addition to gas-powered heating costs to heat their barns. That sounds terrible – until you discover that Carleton Mushrooms grow 10.5 MILLION pounds of mushrooms a year. They choose to grow indoors year-round, so heating is part of the cost of business. When I think that ½ lb of mushrooms cost me $2.25 – $3.00 that 10.5 million pounds must equal a healthy profit for Carleton Mushrooms. I feel no pity for Carleton Mushrooms. Do you?

Studies estimate that the CT adds 1% – 1.5% extra to the cost of food. That’s $1 – $1.50 per $100 order. If that is hard to bear, imagine the price hikes when crops die because it’s too hot, too dry or too wet for them to grow. It’s already begun.

“Access to fresh fruit, vegetables and many other foods could be dramatically limited due to climate change by 2050, according to a new report published in the medical journal the Lancet.”

Mr. Poilievre’s theory is that removing the carbon tax will be better for Canadians. Is he right?

Canadians in provinces that participate in the Federal carbon taxing program get a rebate 4 times a year. Ontario participates so all Ontarians get a rebate by direct deposit or via cheque in the mail.

Carbon taxing is revenue neutral. This means that the government does not make revenue from it. The CT rebate is very helpful to middle and lower-income Canadians – these rebates usually amount to more than they are spending in CT.

The only ones who profit from the removal of carbon taxes and their rebates are the wealthy.